Connect With Our Team

The demand for solar panel installation in India is growing faster than ever. Rising electricity costs, government incentives, and increasing awareness about clean energy have encouraged homeowners and businesses to switch to solar power. However, for many people, the upfront solar panel cost still feels like a major hurdle.

The good news? You no longer need to pay the entire amount upfront. With flexible solar panel EMI plans and easy solar panel loans, installing a solar panel has become affordable for almost everyone. In this blog, we’ll explore EMI and loan options for solar panel installation in India, interest rates, eligibility, and how Sunify Solar helps you go solar without financial stress.

Why Financing Is Important for Solar Panel Installation

Although a solar panel system pays for itself over time, the initial investment can be significant. Many homeowners delay switching to solar simply because they don’t want to disturb their savings.

This is where loans for solar installation play a crucial role. Financing options allow you to install a solar system immediately while paying for it in manageable monthly installments. Instead of paying high electricity bills, you redirect that money toward owning your own solar power system.

With solar system loans, clean energy becomes accessible without compromising financial stability.

What Is the Cost of Solar Panel Installation in India?

The solar panel installation cost in India depends on several factors such as system size, type of panels, rooftop structure, and location.

On average:

-

A 1 kW residential system may cost between ₹50,000 to ₹75,000

-

A 3 kW to 5 kW system suitable for homes ranges higher

-

Commercial systems vary based on energy consumption

While government subsidies help reduce the solar panel cost, financing bridges the remaining gap, making solar more practical for everyday households and businesses.

What Are Solar Panel EMI Options in India?

A solar panel on EMI allows you to divide the total installation cost into monthly payments over a fixed tenure. Many financial institutions now partner with solar providers to offer tailored EMI plans.

Key benefits of solar panel EMI:

-

Affordable monthly payments

-

Zero or minimal down payment options

-

Flexible loan tenure

-

Immediate savings on electricity bills

This option is especially popular among residential users who want long-term savings without upfront pressure.

Types of Solar Panel Loans Available

When it comes to solar panel loans, Indian consumers have multiple choices depending on their financial profile.

1. Bank Loans for Solar Installation

Many public and private banks offer loan for solar rooftop systems under home improvement or green energy schemes. These loans often come with competitive interest rates.

2. NBFC & Private Lender Solar Loans

Non-banking financial companies provide quicker approvals and flexible repayment options for solar system loans, making them ideal for small businesses.

3. Government-Supported Solar Loans

Some financing schemes are linked with government renewable energy initiatives, further reducing the burden of solar panel installation cost.

What Is the Interest Rate on Solar Panel Loans?

Interest rates for solar panel loans typically range between 8% to 14%, depending on the lender and borrower profile.

Factors affecting solar panels loan interest rates include:

-

Credit score

-

Loan tenure

-

Loan amount

-

Type of lender

Compared to personal loans, solar loan interest rates are often lower because solar systems are considered productive assets.

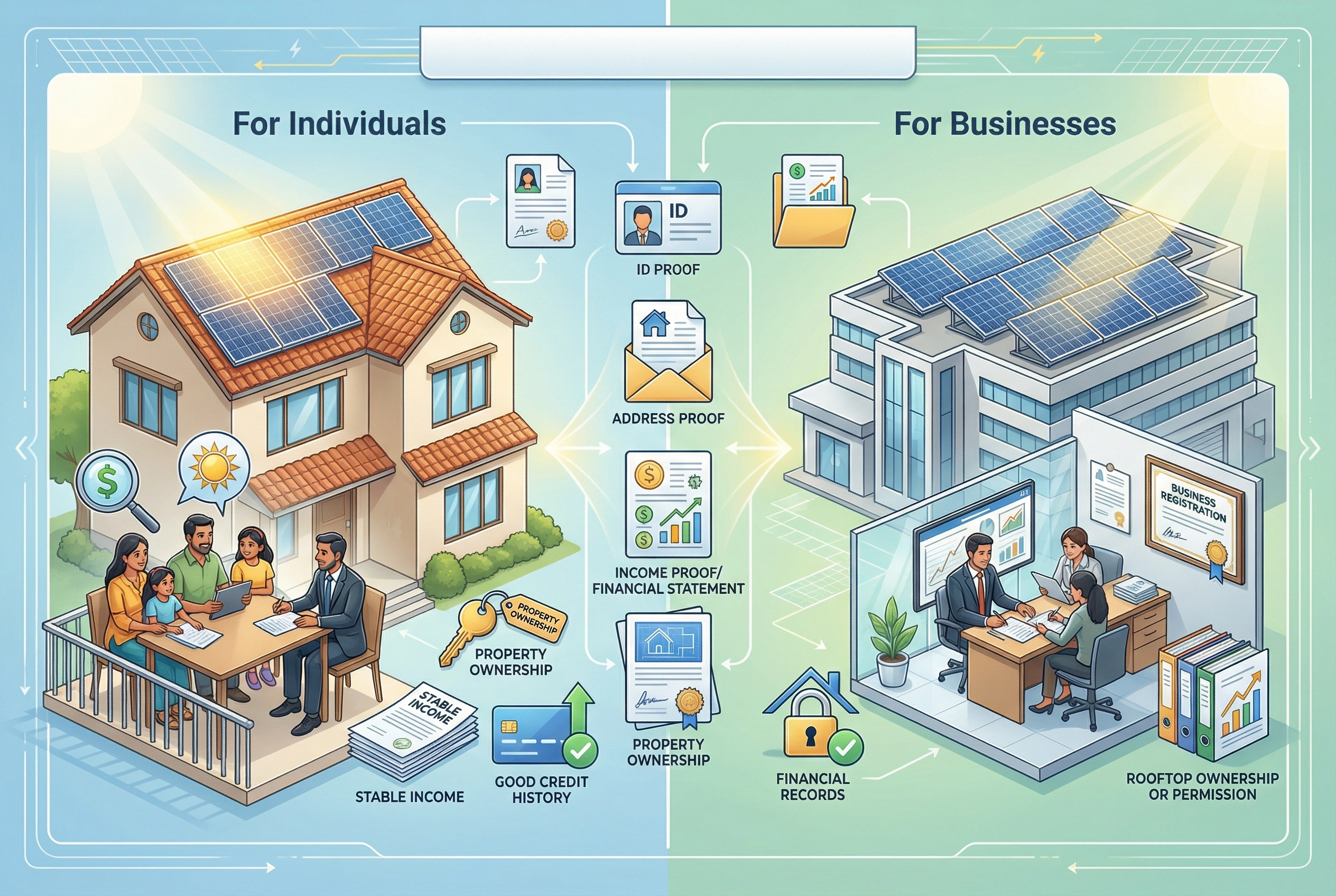

Who Is Eligible for a Loan for Solar Rooftop Systems?

Eligibility for loan for solar rooftop systems is generally simple.

For individuals:

-

Stable income source

-

Good credit history

-

Residential property ownership

For businesses:

-

Valid business registration

-

Financial records

-

Rooftop ownership or permission

Documents usually include ID proof, address proof, income proof, and property documents.

How to Apply for Solar Panel EMI or Loan?

The application process is straightforward, especially when you work with an experienced installer like Sunify Solar.

Steps include:

-

Site assessment and system sizing

-

Cost estimation and EMI calculation

-

Loan application submission

-

Approval and installation

Sunify Solar assists customers at every step, from selecting the right solar panel system to coordinating financing and installation.

Are Solar Panel Loans Worth It?

This is one of the most common questions homeowners ask.

When you opt for solar panel EMI, your monthly installment is often equal to or lower than your current electricity bill. Over time, once the loan is repaid, electricity becomes nearly free.

The long-term savings, combined with rising grid tariffs, make loans for solar installation a financially smart decision with a strong return on investment.

Government Subsidies & Their Impact on Solar Panel Cost

Government subsidies significantly reduce the solar panel installation cost for residential users. These subsidies can be combined with solar system loans, lowering EMI amounts further.

With subsidies and financing together, the barrier to adopting solar energy becomes minimal, accelerating India’s clean energy transition.

Why Choose Sunify Solar for Solar Panel Installation?

Sunify Solar brings expertise, transparency, and customer-first solutions to every solar panel installation project.

Why customers trust Sunify Solar:

-

High-quality solar panels and components

-

End-to-end installation and financing support

-

Assistance with EMI and loan approvals

-

Long-term performance and service assurance

Whether you’re looking for solar panel EMI, competitive solar loan interest rates, or expert guidance, Sunify Solar ensures a smooth and stress-free experience.

Final Thoughts: Go Solar Without Financial Stress

Switching to solar energy no longer requires heavy upfront investment. With flexible solar panel EMI, affordable solar panel loans, and expert support from Sunify Solar, clean energy is now within reach for every Indian household and business.

If you’re planning solar panel installation, financing options make the journey easier, smarter, and financially rewarding.

Connect with Sunify Solar today and start saving with solar one EMI at a time.

Frequently Asked Questions

1. Is solar panel installation available on EMI in India?

Yes, many providers offer solar panel on EMI through banks and NBFCs.

2. Can I get a loan for solar rooftop without collateral?

Most solar panel loans are unsecured, especially for residential systems.

3. How long is the tenure for solar system loans?

Loan tenures typically range from 3 to 10 years.

4. Does EMI affect government subsidy eligibility?

No, subsidies can still be availed along with loans for solar installation.

Recently Posted

Whatsapp Chatx

Hi! Click one of our representatives below to chat on WhatsApp or send us email to solar@sunifysolar.in

|

************** +91 81414 55503 |

We will love to hear from you!